Contribution margin income statements: a complete guide 2024

To find the contribution margin, we subtract the cost of goods sold (COG) from sales revenue. COG includes the costs directly tied to making a product or providing a service. By doing this, we see the gross profit margin, which helps businesses decide on pricing and how to manage costs to generate more money. This step is part of creating a contribution margin statement, which is a type of profit and loss statement. It shows us the money made from selling products or services after covering the costs to make them. This statement highlights the importance of managing regular income, operating income, and the costs involved in making products or services.

Variable Costs in Relation to Contribution Margin

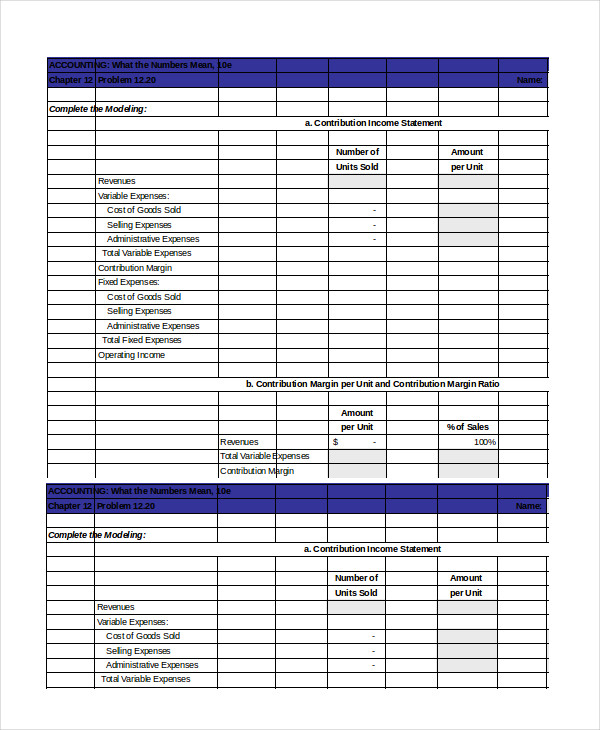

The contribution margin ratio for the birdbath implies that, for every \(\$1\) generated by the sale of a Blue Jay Model, they have \(\$0.80\) that contributes to fixed costs and profit. Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin. The contribution margin income statement shown in panel B of Figure 5.7 clearly indicates which costs are variable and which are fixed. Recall that the variable cost per unit remains constant, and variable costs in total change in proportion to changes in activity. Thus total variable cost of goods sold is $320,520, and total variable selling and administrative costs are $54,000. These two amounts are combined to calculate total variable costs of $374,520, as shown in panel B of Figure 5.7.

What are some advantages of contribution margin income statements?

The concept of this equation relies on the difference between fixed and variable costs. Fixed costs are production costs that remain the same as production efforts increase. The marketing department with the cooperation of research and development department has proposed the production of a new product. Because of limited resources, the new product can only be manufactured if one of the existing products is dropped. In May, 750 of the Blue Jay models were sold as shown on the contribution margin income statement.

Utilizing Contribution Margin to Determine Break-Even Point

It’s a critical number because it tells you if the company’s actually making money or if it’s losing money. Net profit margin is a key part of bookkeeping and helps everyone from the manager to investors understand how well the company is doing. The “contribution income statement” is a special recipe to see how sweet your lemonade sales are. In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\).

How to Improve Contribution Margin

Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. The difference between fixed and variable costs has to do with their correlation to the production levels of a company.

Importance of Contribution Income Statements

For example, if your product revenue was $500,000 and total variable expenses were $250,000, your contribution margin would be $250,000 ÷ $500,000, or 50%. Taxes and other company expenses can obscure how well a company’s products or services perform. This makes the EBITDA figure important for investors looking to put money into a business. A contribution margin is a narrow view of a product or service’s profitability, but the net profit is a much wider and more comprehensive look at a company’s financial performance. If we subtract the variable costs from the revenue, we’re left with a $22,000 contribution margin. For instance, Nike has hundreds of different shoe designs, all with different contribution margins.

- A contribution margin income statement varies from a normal income statement in three ways.

- It’s like when you save money from your allowance after buying something you want.

- A high contribution margin indicates that a company tends to bring in more money than it spends.

- A contribution income statement is a financial report that highlights the contribution margin of a company.

- Second, variable selling and administrative expenses are grouped with variable production costs, so that they are part of the calculation of the contribution margin.

- The fixed production costs were $3,000, and fixed selling and administrative costs were $50,000.

Every dollar of revenue generated goes into Contribution Margin or Variable Costs. What’s left in the contribution margin covers Fixed Costs and remains in the Net Profit / Loss. The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements (IRAs), to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2025. Variable costs, no matter if they are product or period costs appear at the top of the statement. It is helpful to calculate the variable product cost before starting, especially if you will need to calculate ending inventory.

A break-even analysis can help a company determine how much in dollar sales it must generate to break even. This standard format can give you a great financial snapshot of how your business is doing. But if you’d like to dig deeper and shed light on how costs affect your profit, a contribution format income statement can help. A contribution income statement shows what revenue is left after you’ve subtracted the variable expenses. Refer to panel B of Figure 5.7 as you read Susan’s comments about the contribution margin income statement. In a different example than the previous one, if you sold 650 units in a period, resulting in $650,000 net profit, your revenue per unit is $1,000.

ABC Cabinets can use the contribution format for segment analysis, evaluating its two business segments and their relative contribution margins. Managers would have to determine the allocation of variable and fixed costs to each segment. For that, you’ll need a tool that automates data collection, accurately calculates financial insights, and produces customizable reports. Request a free demo and see how Cube can help you save time with all your contribution margin income statements, reports, analysis, and planning. You can’t directly calculate the contribution margin from the EBIT figure, without a breakdown of the fixed and variable costs for each product or service. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. In its simplest form, a contribution margin is the price of a specific product minus the variable costs of producing what is product operations product ops the item. What’s left is the contribution margin, which gives a sense of how much is left over to cover fixed expenses and make a profit. On the other hand, variable costs are costs that depend on the amount of goods and services a business produces.